The Pakistani rupee (PKR) faced another challenging trading session, posting losses against the US Dollar (USD) for the second consecutive day. Opening the day’s trade at 278 in the interbank market, the PKR remained mostly stable throughout the session but eventually closed in the red. This movement marks a continuation of the rupee’s recent downward trend against the dollar, despite showing strength in earlier weeks.

Throughout the trading day, the interbank rate hovered at the 278/$ level, displaying limited fluctuation before settling at the same level at market close. Meanwhile, in the open market, exchange rates across various currency counters remained relatively stable, fluctuating between the 278 and 281 range. This consistency in rates reflects a market that is waiting for new economic signals or interventions that could influence the rupee’s performance.

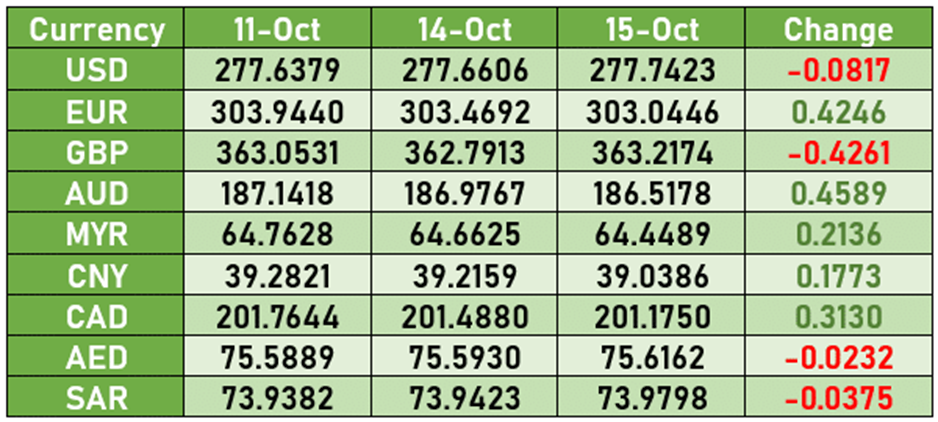

By the end of the session, the rupee had depreciated by 0.03 percent, closing at 277.74 after losing eight paisas against the US Dollar. Although the loss seems minimal, it underscores the rupee’s struggle to maintain ground against the greenback amid a complex economic environment.

Looking at the broader picture, the rupee’s fiscal year-to-date performance reveals a more mixed story. Despite recent declines, the rupee has managed to appreciate by 0.21 percent against the dollar since the beginning of the fiscal year. This suggests that while short-term pressures have taken a toll, the currency has shown some resilience over the longer term.

The rupee’s performance against other major currencies today also presented a varied picture. It saw further depreciation against several regional currencies, losing two paisas against the UAE Dirham (AED) and three paisas against the Saudi Riyal (SAR). Additionally, it experienced a more substantial loss of 42 paisas against the British Pound (GBP), reflecting pressures from global currency markets.

However, the PKR did gain some ground against certain other currencies. It appreciated by 31 paisas against the Canadian Dollar (CAD), 42 paisas against the Euro (EUR), and 45 paisas against the Australian Dollar (AUD). These gains reflect shifts in global currency dynamics and can be influenced by a variety of factors, including economic developments in other regions and changes in commodity prices.

The current market conditions underscore the rupee’s ongoing struggle with volatility, as economic factors both domestically and internationally weigh heavily on its value. While the government’s fiscal measures and efforts to secure foreign exchange reserves have provided some stability, the currency remains sensitive to developments like interest rate decisions, trade balance shifts, and external financial flows.

With the rupee’s performance being closely watched by businesses, traders, and policymakers, the ongoing volatility underscores the need for a balanced approach to monetary policy. Maintaining the stability of the rupee will be crucial as Pakistan navigates its way through a challenging economic landscape, where pressures from inflation, external debt, and international market conditions all play a role.

As the Pakistani rupee navigates these turbulent waters, the eyes of the financial markets remain fixed on policy directions and potential interventions by the State Bank of Pakistan (SBP) that could stabilize the rupee’s value. For now, the PKR’s immediate future remains uncertain, as the market continues to assess the evolving economic conditions and their impact on currency stability.